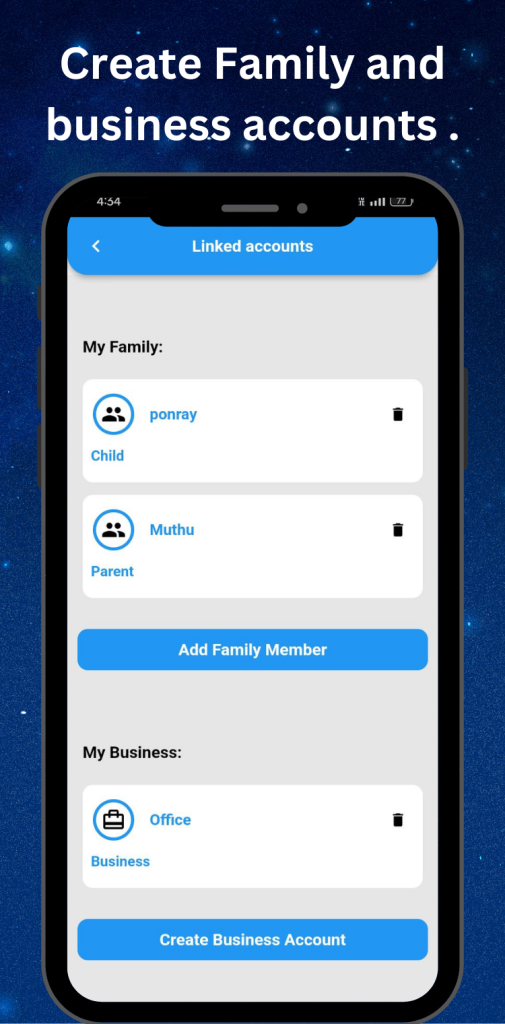

At Billfoldify, we’re constantly innovating to make expense tracking easier, smarter, and more collaborative. With our two new features—Invite Family Members for Shared Expense Tracking and Business Accounts for Professional Expense Management—you can now manage personal and professional finances seamlessly in one app.

Let’s dive into how these features can revolutionize the way you track your expenses.

1. Invite Family Members & Track Family Expenses Together

Keeping track of shared expenses with family members can be challenging, but Billfoldify makes it simple with our new Family Expense Tracking feature.

What Can You Do?

- Invite Family Members: Add your spouse, parents, or kids to a shared family account.

- Track Shared Expenses: Log and categorize joint expenses like groceries, utility bills, or family outings.

- Set Family Budgets: Create a shared budget and monitor progress together.

- View Individual Contributions: See who paid for what and calculate expense splits easily.

How It Works

- Create a Family Group: Use the “Family” section in the app to set up a group and send invites.

- Add Members: Invite family members via email or a unique code.

- Start Tracking: Share expenses, view transactions, and stay in sync with your family’s spending habits.

Why You’ll Love It

- Transparency: Everyone in the family can see expenses and stay informed.

- Collaboration: Work together to achieve financial goals like saving for vacations or paying off debt.

- Convenience: No more spreadsheets or awkward expense calculations—everything is automated!

2. Business Accounts for Professional Expense Tracking

Running a business involves managing complex expenses, and that’s why we’ve introduced Business Accounts to make professional financial management effortless.

What Can You Do?

- Separate Business & Personal Finances: Keep your work and personal expenses organized in distinct accounts.

- Track Business Expenses: Log business-related expenses like office supplies, travel, or client lunches.

- Invoice Integration: Upload invoices, receipts, and bills for easy tracking.

- Generate Reports: Get detailed summaries of business expenses for tax preparation or budget planning.

How It Works

- Set Up a Business Account: Create a dedicated account for your business within Billfoldify.

- Add Transactions: Log expenses manually or link them to uploaded invoices.

- Access Analytics: View graphs and reports to track spending trends and optimize costs.

Why It’s Perfect for You

- Saves Time: Automates tedious bookkeeping tasks.

- Professional Insights: Gain a clear understanding of business expenses to improve profitability.

- Secure Data: Protect sensitive business information with robust encryption.

Why These Features Matter

At Billfoldify, we understand that your financial needs are diverse. Whether it’s managing a family budget or running a small business, our goal is to make financial tracking simple, efficient, and stress-free.

Key Benefits of These Features

- Unified Platform: Manage personal, family, and business expenses all in one place.

- Collaboration-Friendly: Work with your family or team to achieve financial goals together.

- Smart Insights: Use analytics to make informed decisions about both personal and business spending.

Get Started with Billfoldify Today!

With the new Family Expense Tracking and Business Accounts, Billfoldify is more than just an expense tracker—it’s your financial partner.

? Get Billfoldify on iOS

? Get Billfoldify on Android

Take control of your family and business finances with Billfoldify, the ultimate expense-tracking app.